BME Job Fair - Winner

On 11 and 12 March 2025, the BME Job Fair took place, where our company was represented once again. We would like to thank you for the many applications and questions our staff received on the spot.

RAMASOFT has always considered it important to give university students the opportunity to try out their skills in a domestic company in the IT sector, either during or after their studies. Therefore, as an incentive, we wanted to offer a gift to one lucky applicant this year, whose prize was an Apple Airpods 4.

The hand over took place at the RAMASOFT office, congratulations to the winner!

ELTE Career Day - Prize-giving event.

This year, the highly successful ELTE Career Day was organized again on 10 April 2025, where our company was represented. Many interested people visited our stand and informed themselves about our company and our work, which we would like to thank you for!

RAMASOFT pays special attention to university students who would like to find a job and try themselves in the working world alongside their studies. We would like to reward this extra investment of energy. Thus, at this event we also raffled off an Apple Airpods 4, which the winner could personally receive from Dr. Márton Radnai in our office.

Congratulations!

New Regnology ESEF Clients: Graphisoft Park and Gránit Bank Plc.

As both Graphisoft Park and Gránit Bank Plc. choose the service provided by our company, our circle of common clients with Regnology has expanded even further. In result of the joining of the two companies the Regnology ESEF reporting service is being used by a continuously expanding circle of references.

New Regnology ESEF Client: ANY Security Printing Company Plc.

We are pleased to welcome ANY Security Printing Company Plc. as a new user of our Regnology ESEF service. This collaboration strengthens our commitment to innovation in financial reporting.

New clients

We are pleased to announce that our Invoke ESEF service is now being used by AKKO Invest Plc., Amixa Holding Plc., MBH Bank Plc., and the Hungarian Export-Import Bank Plc. In addition, we are participating in the preparation of the Budapest Stock Exchange Plc.'s ESEF-based individual report, which further strengthens our role and expertise in financial reporting.

Introducing Taxatron, the eVAT software.

Choice of filing options

- In the usual way, using the ÁNYK (General Form Filler),

- By accepting the proposal prepared by the tax authority via a web interface, or

- Through machine-to-machine (M2M) connections (by linking enterprise resource planning systems with the NAV system).

Faster and more detailed data provision

Shorter filing time

eVAT declaration, lower risk

More reasons to choose Taxatron

- Built-in validations significantly reduce audit risk, and the pre-prepared analytics cannot be re-requested by NAV.

- No more hassle with preparing the so-called M forms.

- Supplementary data uploading services provided by the tax authority are also exploitable with Taxatron.

- Taxpayers who choose the M2M filing method and correct errors within 15 days through a self-audit procedure after submission do not have to pay a self-assessment penalty.

- Reliable taxpayers who opt for M2M VAT filing cannot receive a tax audit for 15 days, allowing them to conduct self-audits without risk and interruption.

This is the future form of fax filing

Tax Advisory Support

Stock Exchange Museum in the media

-Formatted HTML-

We launched and introduced our new portal, the Stock Exchange Museum, to the domestic media two weeks ago. We are proud that our initiative has attracted the interest of several significant press organs.

Among others, MTI, Economx.hu, Telex.hu, and the online version of Világgazdaság reported on our press conference. We were pleased to accept the invitation from Jazzy Business Class, as well as the requests from Millásreggeli and the Médiaworks Radio News Center.

The highlighted media attention signals to us that it was worth starting our gap-filling project, and it will be worth continuing as well.

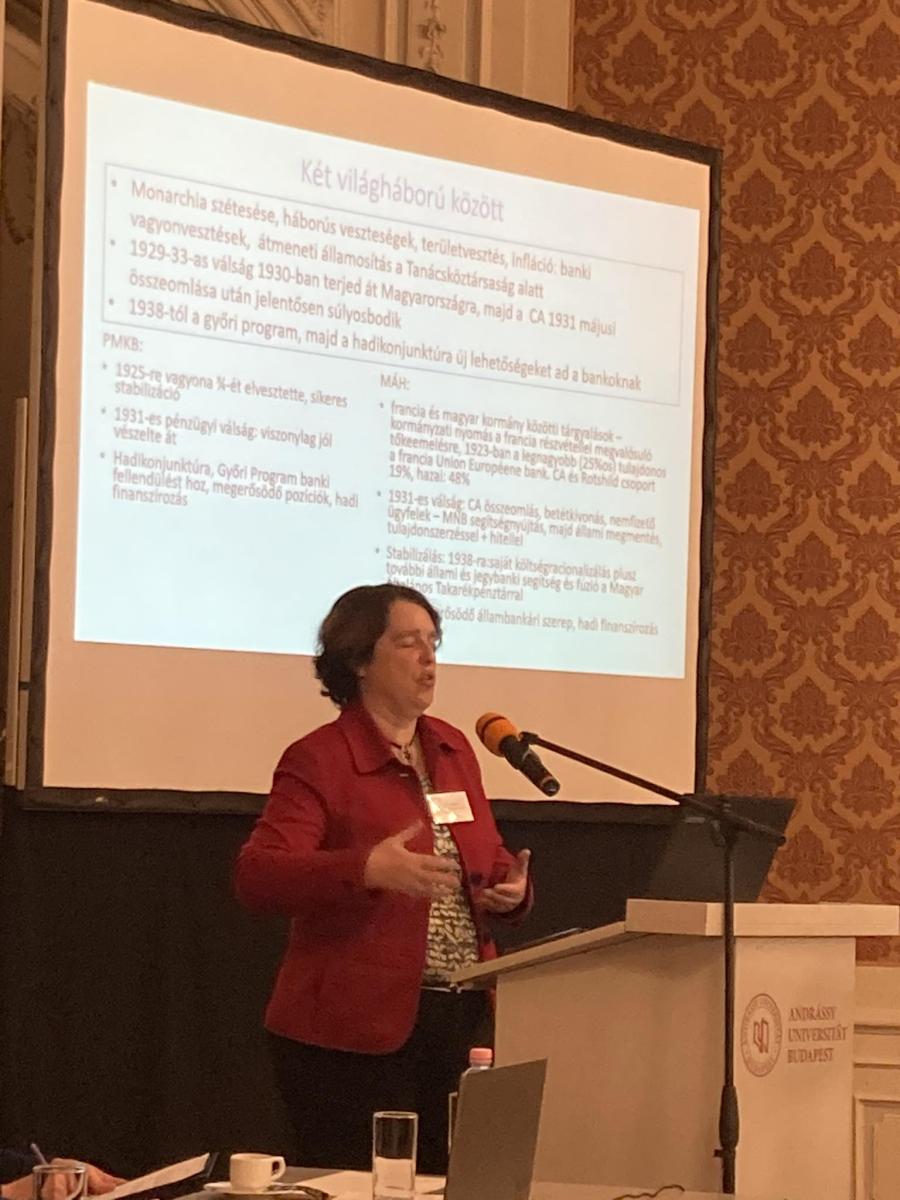

Ramasoft pioneering initiative: Grand presentation of the Stock exchange museum's economic history portal at the Festetics palace

Ramasoft Data Services and IT Plc.'s latest and extraordinary project, the Stock Exchange Museum's economic history portal, was presented on January 18, 2024, at the Festetics palace, within the framework of the Stock exchange museum conference. The event coincided with the 160th anniversary of the establishment of the Budapest Commodity and Stock Exchange, and fittingly paid tribute to Hungarian economic history.

Ramasoft, renowned in the field of banking and stock exchange software development, introduced itself in a new area with this initiative. The project was led by Dr. Márton Radnai, the company's founding owner, and was realized in three phases. In the first phase, stock price and dividend data were processed, in the second phase the databases were uploaded to the portal, and in the third phase, the history of the top 100 stock exchange companies and their leaders was compiled.

The Stock exchange museum portal not only reveals the history of stock exchange companies and the life paths of their leaders but also analyzes the returns of Hungarian stocks. According to the data, between 1864 and 1913, Hungarian stocks achieved an average annual return of 8.41 percent, which is outstanding in international comparison.

Dr. Márton Pelles, the project's research leader, highlighted the challenges of using different currencies in trading, and that the research into the history of the top 100 companies is still ongoing. The Stock exchange museum portal offers an insight into Hungarian economic history and is expected to attract significant interest from both the professional community and the general public. Ramasoft is proud to contribute to the preservation of Hungarian economic heritage and the development of economic awareness in new generations with this project.

For more information, please visit the Stock exchange museum's website.

Ramasoft at Andersen's professional day

New clients

HAPPY 25TH BIRTHDAY RAMASOFT!

This year is particularly important for Ramasoft, as it celebrates its twenty-fifth anniversary this year.

The event was held at a gala dinner on 22 November at the Budapest Marriott Hotel*****.

Among those present, we welcomed current and former colleagues, as well as partners and customers who have been with us for twenty-five years.

Dr. Márton Radnai, CEO, summarized the two and a half decades of the company's history, mentioning the main milestones and future plans.