The product – Creditron Basel III reporting system

This product is a reporting system developed by Ramasoft which adapts the latest international methods to current market conditions, and enables users to:

-

calculate credit and operational risk capital requirements in compliance with the EU regulation (575/2013, CRR) on capital adequacy, and prepare the COREP reports based on those calculations;,

-

calculate economic capital at the client level and prepare internal reports based on those calculations;,

-

as well as create a database that stores transactions chronologically and in a manner which supports the above..

Implemented approaches of Basel III

The system calculates of capital requirements according to the following approaches, specified in the proposed Basel III regulations:

-

Credit risk capital requirement: standard, IRB foundation, IRB advanced approach, combination of the methods,

-

Financial collaterals: simple, comprehensive method,

-

Volatility estimation: supervisory, own model,,

-

PD estimation: pool-based and mapping-based,,

-

LGD estimation: pool-based,,

-

Operational risk capital requirement: basic indicator approach, standardised approach, alternative standardised approach.

The choice of the approaches is at the portfolio (pool) level, thus making it possible to handle the sovereign, institutional and corporate clients of the bank under the standardised approach while handling the SME and retail clients through the IRB approach.

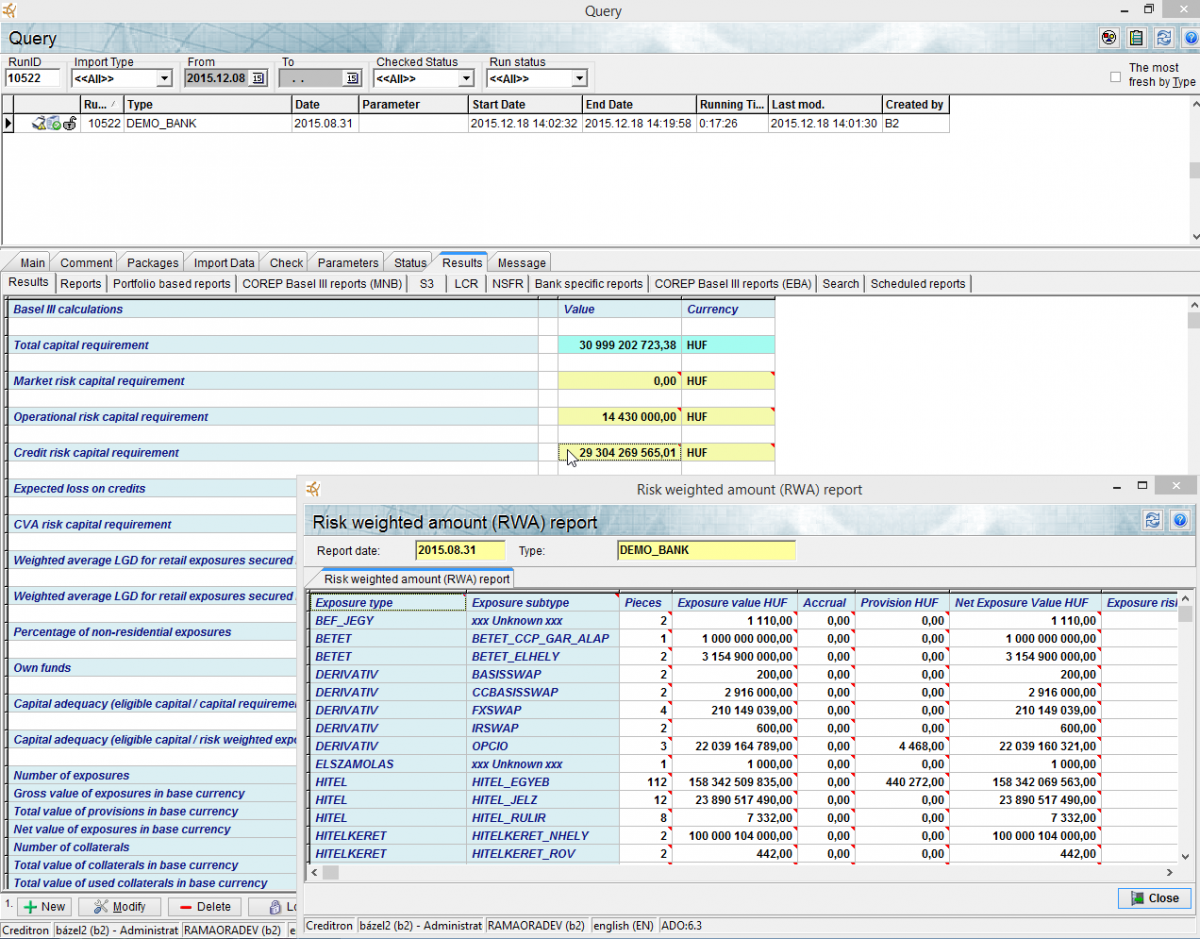

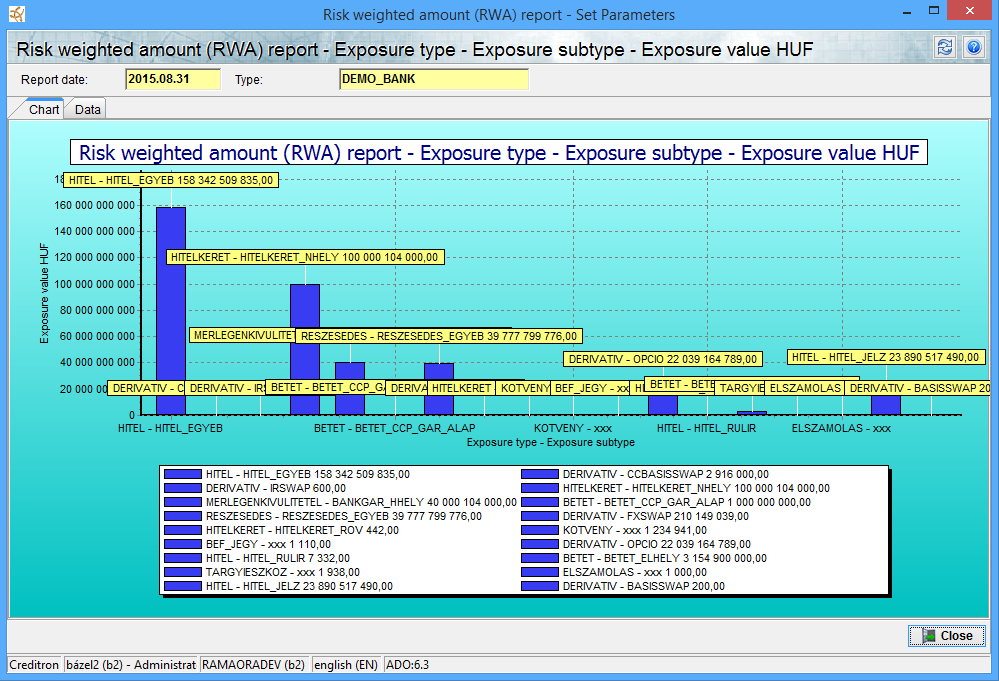

Display and analysis of results

The results of calculations and intermediary results can be displayed either in a table or in graphical form, which can be exported to different file types. If the result is exported to Excel, the format of table remains unchanged.

Calculated results in the table can be detailed by clicking on the field containing the calculated value – thus enabling users to drill down to elementary data.

Basel III reports prepared by Creditron

Local regulatory reports

The software fills in the regulatory report templates issued by the Hungarian National Bank, or it can transmit these to another report-making software in TXT format, so that the preparation of these reports does not require human intervention.

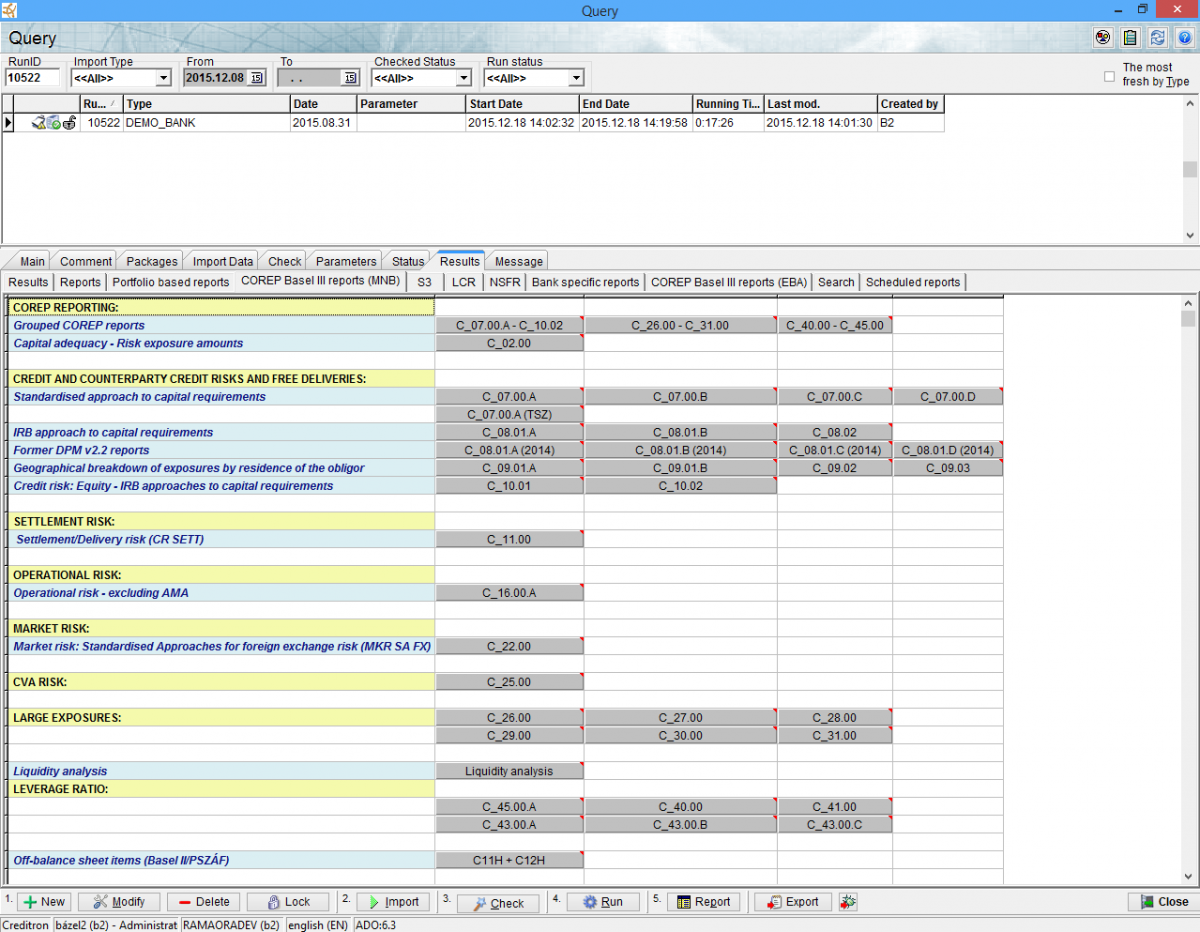

COREP reports

After the calculations, Creditron fills out the mandatory PSZAF reports called COREP. All fields containing a value of the COREP reports can be detailed. The reports are designed to make the drill downs and the summations simple and user-friendly, thus supporting data analysis and the reporting process.

Internal reports

The system makes it possible to analyse stored data not only for statuary reports, but also for internal purposes. If the client specifies different characteristics for transactions (branch, product, etc.), capital requirement can be calculated for sub-portfolios segmented by those characteristics.

These data provide a sound basis for the development of a risk based capital allocation between the bank's businesses, and the introduction of RAROC calculations. For example, it is very useful for the comparison of average risk weights (capital requirement/book value) of different geographic regions or products.

The Basel III capital requirement report shows the value of the required capital in terms of market risk, credit risk and operational risk. The depth of the report is decided by the user since it is possible to view the details as well. This detailed view for credit risk capital requirements shows the following as liability types and subtypes:

-

Number of items

-

Original value HUF

-

Exposure Value HUF

-

Modified Exposure Value HUF

-

Unsecured Exposure Value HUF

-

FUnsecured Modified Exposure Value HUF

-

Risk Value

-

Risk Weighted Amount

-

Provision HUF

-

Used Collateral HUF

Besides these, different custom reports can also be made in Creditron, which can be divided as follows:

-

General reports

-

One-dimensional reports

-

Two-dimensional reports

Parameter maintenance

Currently the following parameters can be set by the user:

-

supervisory volatility adjustments,

-

risk weights under the standardised approach,

-

risk weights assigned to a credit assessment by a nominated ECAI,

-

and the beta factors of the operational risk methods.

Details about Creditron RG module