Benefits of Pozitron

-

Decreasing manual work of investment managers and consultants (reporting, consulting) – increase of efficiency,

-

Private banking consulting to a wider range of clients - increasing market share,

-

Taking higher risk and more frequent transactions - increasing income,

-

Competitive advantage because of high quality customer service - increasing market share,

-

Surveying activities of consultants and business units - management support.

Fields of use

-

Consulting and asset management for institutions,

-

Private banking consulting and asset management,

-

Consulting and asset management with unit- linked insurance contracts.

Calculation functions

The aim of the calculation functions is to measure the value, risk and historical performance of portfolios. The most important methods used by professional users become available for clients as well.

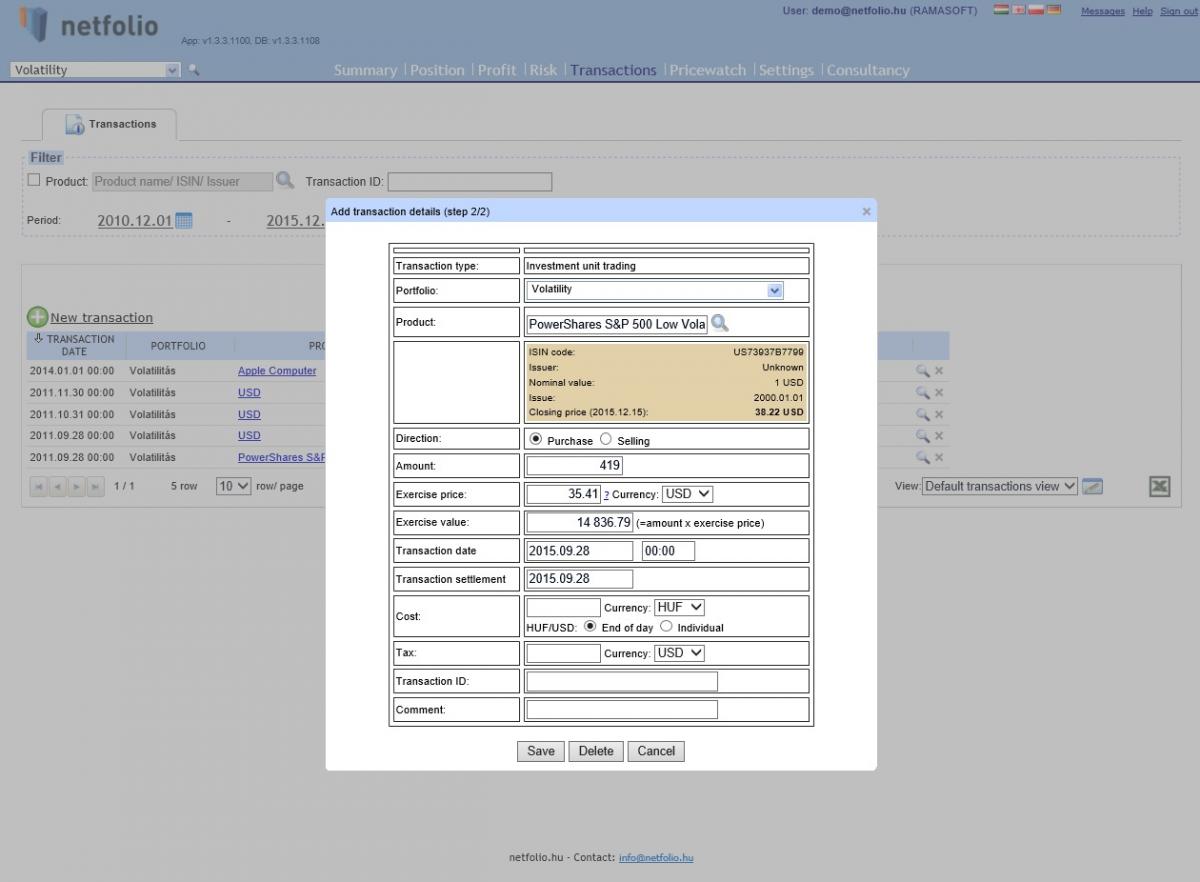

Consulting functions

The purpose of the consulting functions is to create the highest return portfolio in connection with the risk profile of each individual client. The graph helps to analyse the diversification of the portfolio, and when designing the investment strategy, it can display the investment risks and returns. The graphical representation of the risk/return value pairs of products in the portfolio provides support in choosing between products bearing the same risk but higher return. The system is able to display the optimal portfolio curve and to determine the composition of the highest-return portfolio according to a certain risk level.

Management functions

The system is able to perform calculations not only on the level of client portfolios but also on aggregate levels. By mapping the organisation structure, the portfolio value can be calculated at the consultant, department, or business unit levels, tracking the development of business units over time. This function can support strategic planning, product development, and the identification of portfolios that differ in certain respects.

Reporting functions

The reporting functions of the system allow consultants using Pozitron to compile PDF reports, and to send these reports regularly (annually, monthly, weekly, daily – even automatically via email) to inform clients of the value and return of their portfolios. Consultants can choose among a variety of customizable reports:

-

Summarising portfolio report (according to MiFiD requirements),

-

Detailed portfolio analysis,

-

Personal income tax calculation.

General functions

The consultants may reach the portfolio evaluation system via intranet, while the clients are able to connect via internet- in case of demand- to the extent of their authorities of course.

Data supply

Ramasoft’s data supply service can be connected to the system so that the maintenance of financial products and the provision of end-of-day price data do not require integration. The system has a real-time price interface as well. Real-time data can be provided through our international data supplier partners.

Technical implementation

Pozitron uses a three-tier web architecture, meaning that if it is used with a proper browser, it does not require installation for clients. All system components are scalable, so it works reliably and with fast response times even with several thousands of users. Because the solution prioritises IT security, a system-wide application security audit was conducted by the IT security consulting team of an international consultant agency which is the leader in the Hungarian banking sector.

-

Modern technology using AJAX web client (Internet Explorer, Firefox supported),

-

Coloured Java charts,

-

Multi-level access control,

-

Use of comprehensive IT security solutions,

-

All the components of the server application are scalable,

-

Multi-platform implementation.