As a result of a new development in our Creditron system, we are now able to provide the EVAN data required by the MNB regulation. The module is ideal for supporting the development, testing and trial run of a EVAN data production project, and later for quality assurance of live data delivery - data verification and data cleansing tasks.

The main benefits of the module for the Customer are:

- Ready to use system: no development required

- Closed system: manual changes are logged, reusable

- Verification before anonymization: if anonymization is done in the system, records can be verified in their original form, clients are easier to "find", reconciled with the basic system

- Correction and verification in one system: the effect of corrections can be checked immediately, no need to wait for another colleague to send in the report and return the result

- Faster verification: the MNB system is overloaded on deadline day, it can take hours to download the error list

- Tracking: changes to the data model and rules are tracked by the supplier, no need for internal resources

EVAN module features:

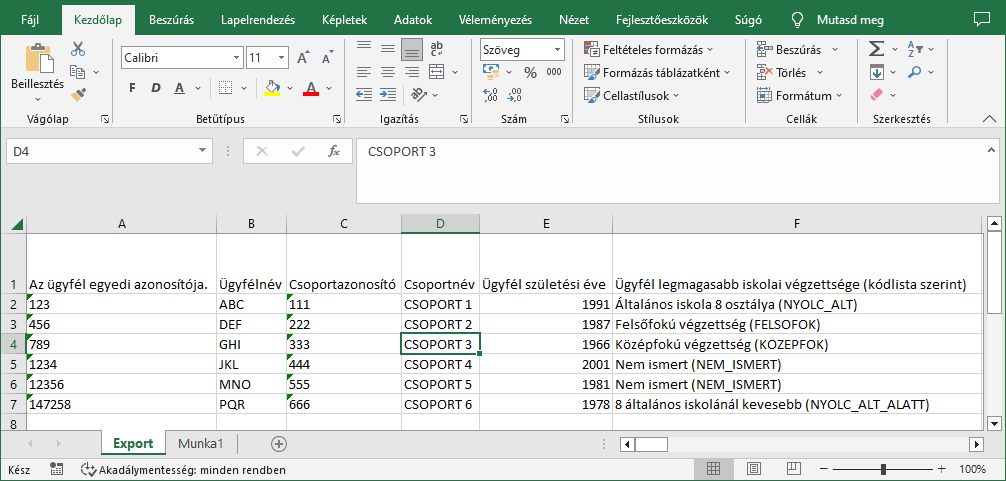

1.Loading basic data from database in addition to manual data loading

Data loading is typically done from a database, but there are some data that is not yet or not properly included. It is then possible to supplement the database with manually maintained data sources (e.g. excel spreadsheets).

2. Anonymisation

The anonymous identifier is created on the basis of MNB Regulation No. 35/2018 (13.11.2018). It is also possible to choose not to have Creditron form the anonymous identifier for customers. This is anonymisation without function.

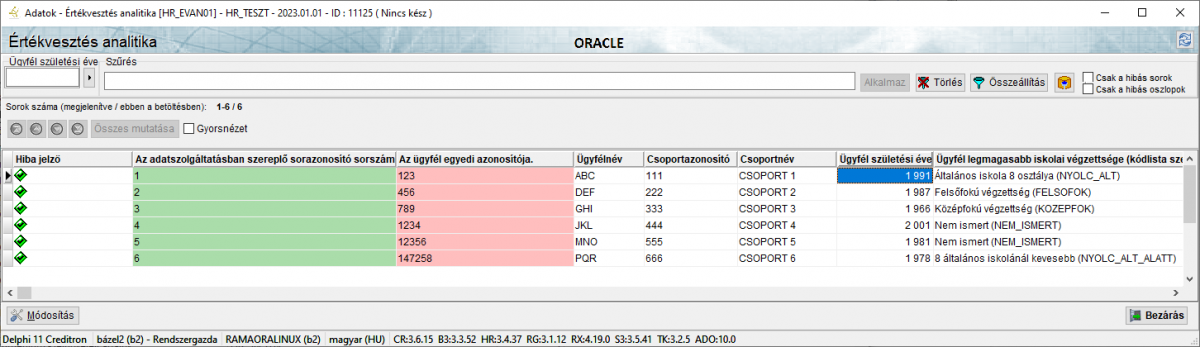

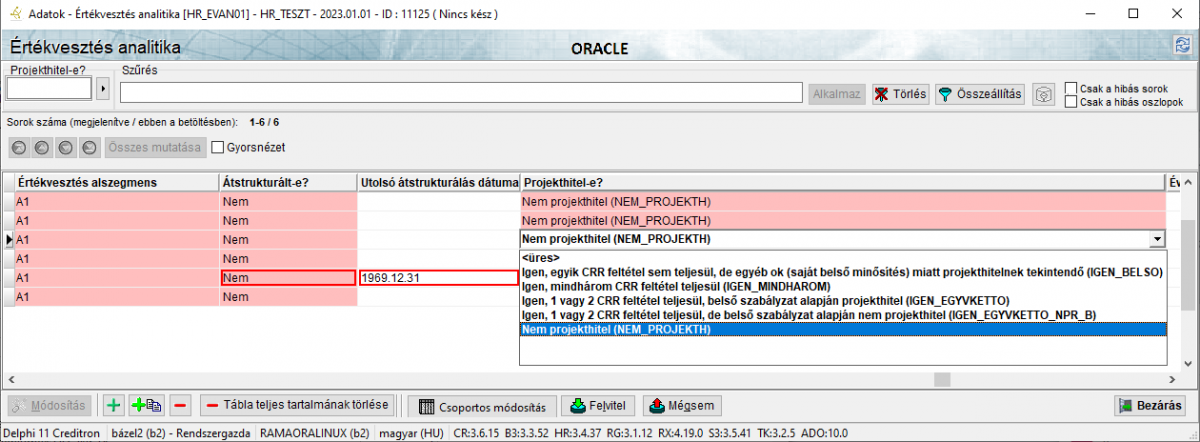

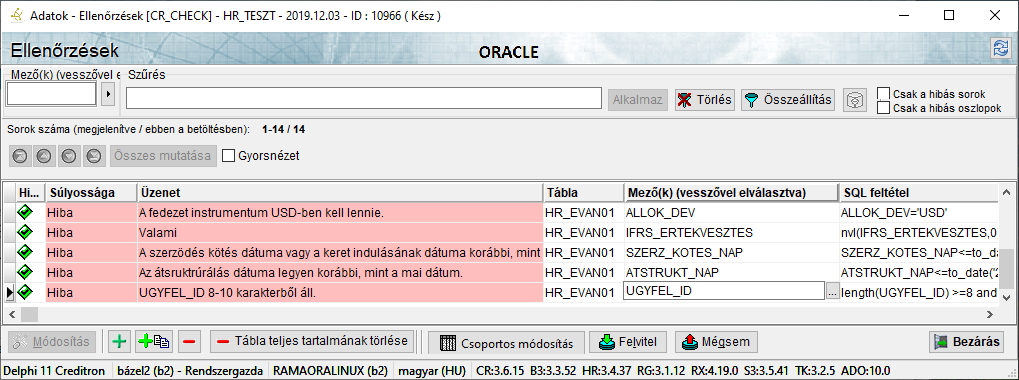

3. Check

During the verification process, the system checks the predefined contexts defined by the MNB. During verification, cells with errors are marked with a red frame. A correction is provided and a group correction can be performed, so that all records displayed can be corrected together.

It is also possible to set up additional internal checks in addition to the MNB checks.

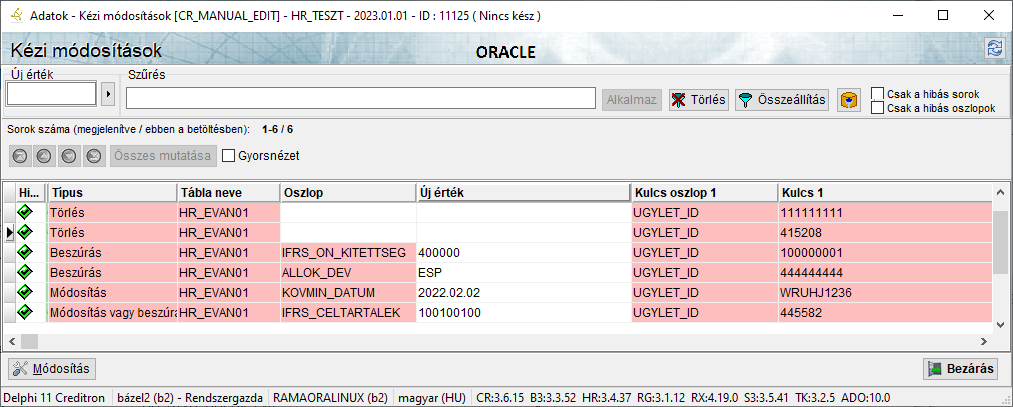

4. Manual corrections

Manual corrections made in a given period can be recorded and saved so that they can be applied in a subsequent period.

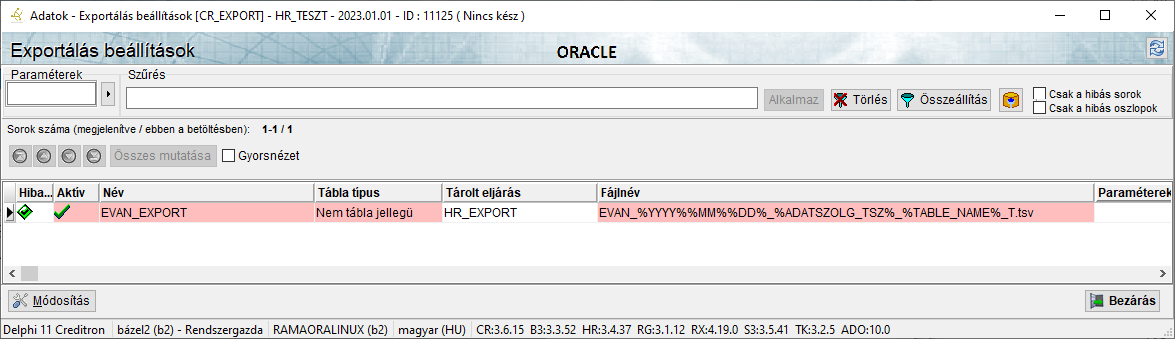

5. Data export

The EVAN data model can be exported from Creditron according to centrally defined conditions.

6. Editing the EVAN data model and its data relations

As part of a flat-fee rights tracking service, we undertake the ongoing tracking of the EVAN data model and control rules, which can be viewed in the built-in data modelling tool.